Hong Kong’s Biotech Listings Emerge From Two-Year Downturn With 18As Booming

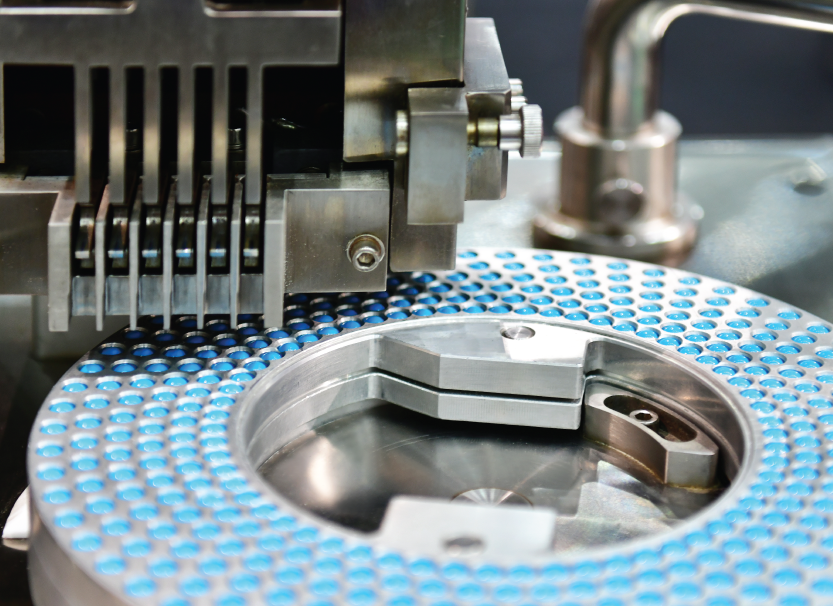

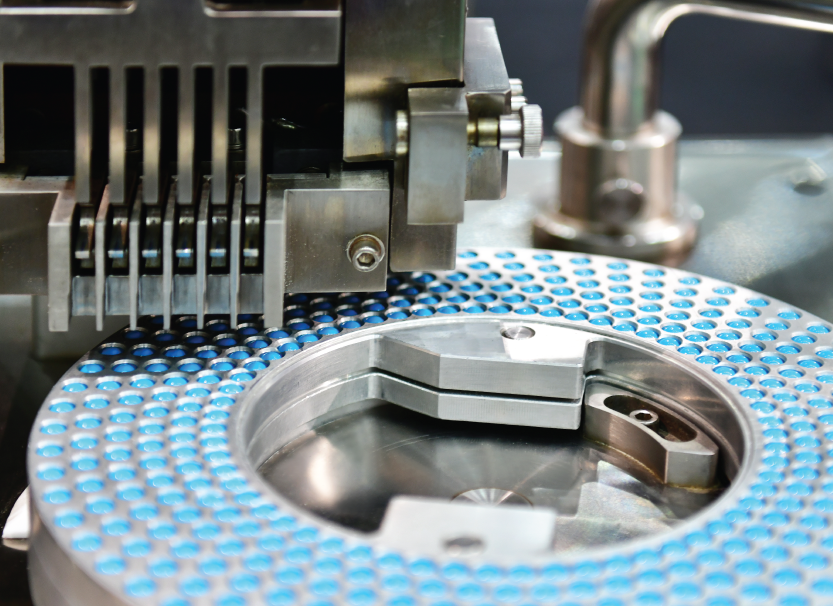

Biotech and medtech startups based in the People’s Republic of China (P.R.C.) are flocking to Hong Kong to float. Meng Ding explains how a combination of listing reforms and an explosion of innovation in the Greater Bay Area have led to Hong Kong’s 18A process being popular for life sciences.

Globally, biotech investment and fundraising are ramping up, and this is positively impacting the Hong Kong listings market. Many life sciences companies that started Hong Kong’s 18A IPO process before 2022, and then suspended it during the downturn for biotech capital raising, are now looking to revive their applications during the 2024 listing window.

These include P.R.C.-based biotech companies, many of whom are now preferring an IPO in Hong Kong to one in the U.S. We have recently seen some P.R.C.-based biotechs achieve close to a 200 times oversubscription for their Hong Kong tranche allotments. This type of heavy oversubscription of a biotech company is the clearest indication yet that the market is recovering after a two-year downturn, with particular renewed enthusiasm in Hong Kong’s 18A process. We have seen 21 P.R.C-based biotech listings in Hong Kong since the start of 2022.

The increase in P.R.C.-based startups going to Hong Kong to float is partly due to the current upturn in the global biotech cycle. At the regional level, the Stock Exchange of Hong Kong Limited (HKEX) has long been a top-ranked IPO venue, and Shanghai has been consolidating its position as a hub for the P.R.C’s biotech industry. This means that Hong Kong finds itself in a gateway position between the mainland and the global healthcare market, with more P.R.C.-incorporated biotech companies listing on the HKEX in recent years and robust follow-on fundraising round in evidence.

The Guangdong-Hong Kong-Macau Greater Bay Area is also growing as an innovation hub, with Hong Kong being the main finance center of the area. But Hong Kong is not just a financial hub, biotech research clusters have also been emerging there, although the Hong Kong biotech market lags around 15 years behind that of the U.S., and is currently undergoing its first major cycle.

On the mainland, we now see a situation in which many P.R.C.-based start-ups are emerging as innovators in the life sciences sector, the P.R.C. is funneling investment into them at an early development stage and the HKEX is then providing the gateway to them to connect to healthcare markets around the world.

The HKEX’s 2018 listing reforms have also been a main driver for opening the market’s doors to emerging and innovative companies, including biotech. When it comes to biotech listings within the P.R.C., there are specific criteria – currently in their fifth iteration – which are similar to that of Hong Kong’s 18A process. These include specific requirements in terms of revenue, core products, and the degree of scientific innovation of a biotech’s product offering.

But many P.R.C.-based biotech and medtech startups are opting for a Hong Kong listing because this venue is perceived to have good consistency in terms of its rules and vending standards, which do not tend to change from cycle to cycle. We are also seeing some interest from Singapore-based startups in a Hong Kong floatation, but the main driver of the Hong Kong biotech market is currently coming from P.R.C.-based innovators.

This post is as of the posting date stated above. Sidley Austin LLP assumes no duty to update this post or post about any subsequent developments having a bearing on this post.